Operating Leverage Factor. Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on accounting4management.com. Sales $526,500 variable costs 363,300 fixed costs 122,400 determine decatur company's operating.

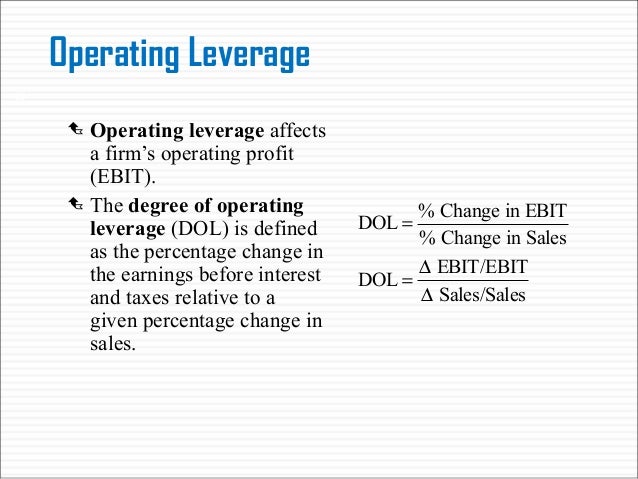

The degree of operating leverage (dol) is a financial ratio that measures the sensitivity of a company’s operating income operating income operating income is the amount of revenue left after deducting the operational direct and indirect costs from sales revenue. It is also known as the “degree of operating leverage or dol.” please note that the greater use of fixed costs, the greater the impact of a change in sales on the operating income of a company. Risk factor loadings on deployed assets and growth options.

The Degree Of Operating Leverage (Dol) Is A Financial Ratio That Measures The Sensitivity Of A Company’s Operating Income Operating Income Operating Income Is The Amount Of Revenue Left After Deducting The Operational Direct And Indirect Costs From Sales Revenue.

It is also known as the “degree of operating leverage or dol.” please note that the greater use of fixed costs, the greater the impact of a change in sales on the operating income of a company. A business that generates sales with a high. Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on accounting4management.com.

The Following Two Scenarios Describe An Organization Having High Operating Leverage And Low Operating Leverage.

It is used to evaluate the breakeven point of a business, as well as the likely profit levels on individual sales. The operating leverage factor will be exactly 1 only if a company has no fixed costs. This measure is called dol or degree of operating leverage.

The Operating Leverage Ratio Is Basically The Ratio Of Fixed Costs To Variable Costs.

Operating leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. The operating leverage factor indicates the percentage change in operating income that will occur from a 5% change in volume. Dol is often combined with two other measures of leverage, the degree of financial leverage (dfl) and the degree of total leverage (dtl).

Operating Leverage Is Interpreted As A Factor Of Variability In Financial Results.

Contribution mar gin per unit / selling price per unit. It also predicts that high operating leverage firms earn higher This financial metric shows how a change in the company’s sales will affect its.

Operating Leverage Is A Measure Of How Revenue Growth Translates Into Growth In Operating Income.

Operating leverage tells you how fast your operating income grows in relation to your sales. In other words, the ratio measures how much the operating profit of a company increases of a company increases with the increase in its revenue, primarily due to better. Its main purpose is to calculate where a company’s breakeven point is.

Related Posts

- Vant Hoff Factor Of Mgso4Vant Hoff Factor Of Mgso4. Based on the formulas of the following solutes, which compound would have the smallest van't hoff factor (i)? The van ...

- Definition Of The Greatest Common FactorDefinition Of The Greatest Common Factor. Search greatest common factor and thousands of other words in english definition and synonym dictionary fro ...

- Deferential Vulnerability Might Be A FactorDeferential Vulnerability Might Be A Factor. The correct answer is c. Give an example of a situation where deferential vulnerability might be a facto ...

- Greatest Monomial Factor CalculatorGreatest Monomial Factor Calculator. Gcf of polynomials x^2+2x+1 , x+1 gcf of polynomials 110x^5 , 70x^7 , 60x^8 Here we shall discuss factoring one ...