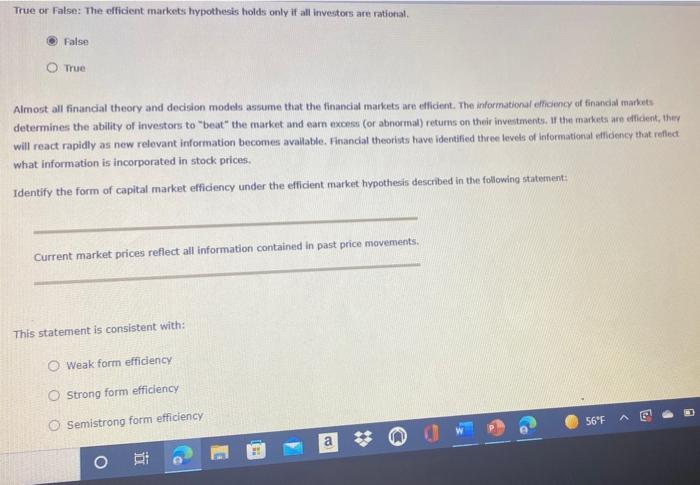

The Efficient Market Hypothesis Holds Only If All Investors Are Rational. Current market prices reflect all relevant publicly available information. The efficient markets hypothesis holds only if all investors are rational.

The efficient market hypothesis (emh) states that any new information that arrives in the market is quickly mirrored in the stock prices. Almost all financial theory and decision models assume that the financial markets are efficient. (i) false (ii)true the informational efficiency of financial markets determines the ability of investors to beat the.

Current Market Prices Reflect All Relevant Publicly Available Information.

The efficient market hypothesis (emh) states that a market is efficient if security prices immediately and fully reflect all available relevant information. If that’s true, then the only way investors can generate superior returns is by taking on much greater risk. The efficient markets hypothesis holds only if all investors are rational.

False True Almost All Financial Theory And Decision Models Assume That The Financial Markets Are Efficient.

So, neither technical analysis (study of past stock prices and its patterns) nor fundamental analysis (study of a company’s financial information) can generate excess returns for an investor in comparison to another investor. The efficient markets hypothesis holds only if all investors are rational. The informational efficiency of financial markets determines the ability of investors to beat the market and earn excess (or abnormal) returns on their investments.

Leave A Reply Cancel Reply.

The efficient markets hypothesis holds only if all investors are rational strong form efficiency almost all finacial theory and decision model assume that the financial market are efficient. Anytime market volume exceeds the average trading volume. The variability of the stock price is thus reflected in the expected returns as returns and risk are positively correlated.

The Efficient Market Hypothesis (Emh) Is A Theory Of Investments In Which Investors Have Perfect Information And Act Rationally In Acting On That Information.

Conceptually, this picture makes sense. 1 📌📌📌 question true or false: The efficient markets hypothesis holds only if all investors are rational.

0 False 0 True Almost All Financial Theory And Decision.

The efficient markets hypothesis holds only if all investors are rational. Efficient market theory holds that financial markets are efficient because investors are rational. O false o true almost all financial theory and decision models assume that the financial markets are efficient.

Related Posts

- Unlike Freestanding Sculpture This Type Of Sculpture Is Created To Be Viewed From One Side OnlyUnlike Freestanding Sculpture This Type Of Sculpture Is Created To Be Viewed From One Side Only. Objects found or already existing outside of the con ...

- What Conditions Make A Market Perfectly CompetitiveWhat Conditions Make A Market Perfectly Competitive. A perfectly competitive market is one in which the number of buyers and sellers is very large, a ...

- Is The Product Of Two Irrational Numbers Always RationalIs The Product Of Two Irrational Numbers Always Rational. What is the product of two rational numbers? Thus, given statement is :Can the product of t ...

- What Kind Of Question Can Only Be Answered Upon ReflectionWhat Kind Of Question Can Only Be Answered Upon Reflection. Read through the following three lists to get some ideas for introspective questions. In ...